The Definitive Guide for Insurance Code

Wiki Article

The Main Principles Of Insurance Account

Table of ContentsAn Unbiased View of Insurance AsiaExamine This Report about Insurance AdvisorUnknown Facts About Insurance AdvisorSee This Report on Insurance AsiaThe 20-Second Trick For Insurance Companies

Various other types of life insurance policyGroup life insurance coverage is commonly used by employers as component of the business's work environment advantages. Premiums are based on the group overall, rather than each individual. In basic, companies provide basic protection totally free, with the alternative to acquire additional life insurance if you need more coverage.Mortgage life insurance policy covers the existing equilibrium of your home mortgage and also pays out to the lender, not your household, if you pass away. Second-to-die: Pays after both policyholders die. These plans can be made use of to cover estate taxes or the treatment of a dependent after both insurance policy holders pass away. Frequently asked inquiries, What's the most effective kind of life insurance policy to get? The ideal life insurance coverage policy for you comes down to your demands and spending plan. Which types of life insurance policy offer versatile costs? With term life

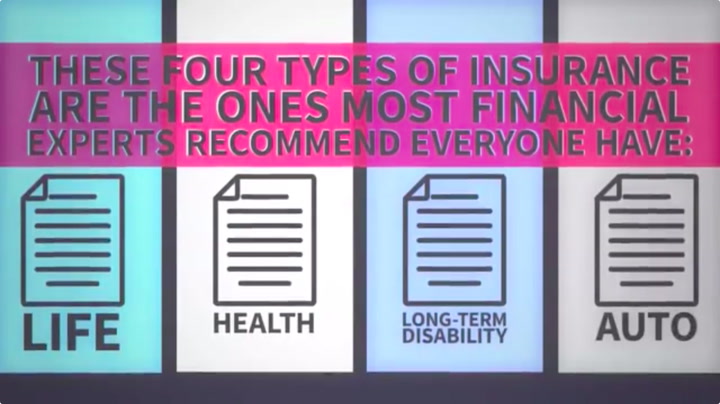

insurance and entire life insurance policy, premiums normally are taken care of, which means you'll pay the same amount on a monthly basis. The insurance policy you need at every age differs. Tim Macpherson/Getty Images You require to buy insurance to shield on your own, your household, as well as your wide range. Insurance coverage might save you thousands of bucks in the occasion of a crash, ailment, or calamity. Health and wellness insurance coverage and car insurance coverage are called for, while life insurance policy, homeowners, tenants, and also handicap insurance coverage are motivated. Begin free of cost Insurance policy isn't one of the most exhilarating to consider, yet it's necessaryfor safeguarding on your own, your family, and your wealth. Accidents, health problem, and catastrophes take place all the time. At worst, occasions like these can dive you right into deep monetary spoil if you don't have insurance coverage to fall back on. Plus, as your life changes(claim, you obtain a new job or have a child)so should your coverage.

The 15-Second Trick For Insurance Ads

Listed below, we've described briefly which insurance protection you must highly consider purchasing at every stage of life. Once you leave the functioning world around age 65, which is frequently the end of the lengthiest plan you can purchase. The longer you wait to acquire a policy, the greater the eventual expense.If somebody else counts on your earnings for their financial wellness, after that you possibly need life insurance. Even if you don't have dependents, there are various other factors to live insurance policy: private trainee finance debt, self-employment , or a family-owned service. That's much less than the cost of a fitness center membership to secure your household's financial security in your absence. The finest life insurance policy for you relies on your budget as well as your financial goals. There are two major sorts of life insurance policy plans to select from: permanent life and also term life. When your dependents are no longer relying upon you for financial backing. Insurance policy you need in your 30s , Property owners insurance, Homeowners insurance is not called for by state legislation. If you have a mortgage, your loan provider will certainly need homeowners insurance to protect the investment.Homeowners insurance policy shields the house, your belongings, and also supplies liability insurance coverage for injuries that take place on your building.If you sell your residence and also return to renting, or make other living arrangements. Pet dog insurance policy Family pet insurance might not be taken into consideration a must-have, unless. insurance commission.

Excitement About Insurance Agent

you want to insurance exams shell out $8,000 for your pet's surgical treatment. Some plans even cover routine veterinarian visits and also inoculations, and also a lot of will certainly repay as much as 90%of your vet costs. This is where long-term care insurance or a hybrid policy enters play. For people that are aging or impaired as well as need assist with daily living, whether in a nursing home or via hospice, lasting care insurance can aid bear the excessively high costs. Long-term care is expensive. Nonetheless, the majority of Americans will certainly need long-term treatment at some time during their retirement. You are going to Spain for the very first time. insurance quotes. You have a stop-over at Abu Dhabi. Your very first trip gets postponed. You miss the 2nd flight as well as obtain stuck. You are driving to work like every various other day. The road has oil spill.

The Best Strategy To Use For Insurance Asia Awards

Endowment Policy -Like a term plan, it is also legitimate for a particular duration. Money-back Policy- A particular portion of the amount assured will be paid to you periodically throughout the term as survival benefit. -Your family obtains the whole sum guaranteed in case instance death fatality the policy periodDurationWhat is General Insurance coverage? A general insurance coverage is a contract that supplies economic payment on any kind of loss besides fatality. You could, therefore, go on as well as stun your companion with a diamond ring without fretting about the treatment costs. The damage in your auto didn't create a dent in your pocket. Your electric motor insurance policy' own damage cover spent for your vehicle's problems triggered by the mishap.

Insurance Agent Job Description for Dummies

In reality, the insurance company resolved the costs straight at the garage. Your medical insurance took care of your treatment expenses. Your financial savings, therefore, stayed untouched by your sudden ailment. website link As you can see, General Insurance coverage can be the response to life's different problems. However, for that, you require to choose the best insurance coverages from the myriad ones offered. What are the sorts of General Insurance readily available?/ What all can be guaranteed? You can obtain practically anything and also every little thing guaranteed. Pre-existing illness cover: Your health and wellness insurance cares for the therapy of illness you might have prior to purchasing the health and wellness insurance coverage policy. Crash cover: Your medical insurance can spend for the clinical therapy of injuries triggered due to mishaps as well as accidents. Your health insurance coverage can also help you conserve tax obligation.Two-wheeler Insurance coverage, This is your bike's guardian angel. It's comparable to Automobile insurance coverage. You can not ride a bike or scooter in India without insurance coverage. Just like automobile insurance policy, what the insurance firm will pay depends on the kind of insurance policy and what it covers. Third Event Insurance Policy Comprehensive Vehicle Insurance Policy, Compensates for the damages created to an additional person, their vehicle or a third-party home.-Damages created due to man-made activities such as riots, strikes, etc. Residence structure insurance This safeguards the framework of your residence from any type of threats and problems. The cover is additionally reached the irreversible fixtures within your home such as kitchen and restroom installations. Public responsibility coverage The damage triggered to an additional individual or their property inside the insured home can likewise be made up.

Report this wiki page